An interest bearing note represents funds loaned by a lender to a borrower, on which interest is accrued in accordance with the terms of the agreement. … A third example of an interest bearing note is a long-term loan to a company, which is used to support its funding requirements over a multi-year period.

Just so, How do you calculate interest notes payable?

Calculating Interest Expense

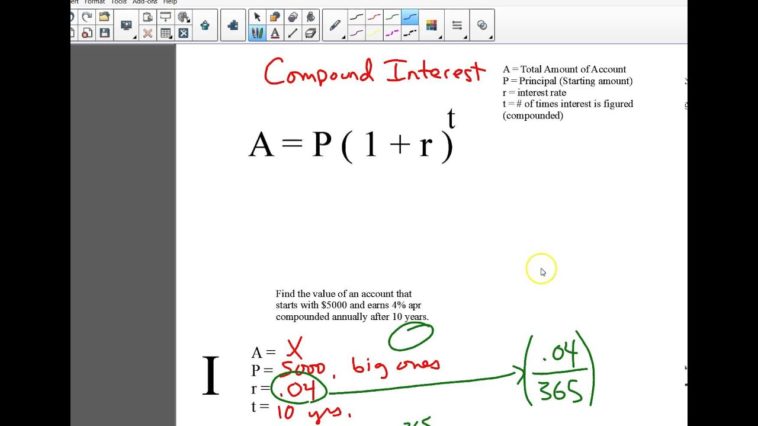

Divide the annual interest expense by 12 to calculate the amount of interest to record in a monthly adjusting entry. For example, if a $36,000 long-term note payable has a 10 percent interest rate, multiply 10 percent, or 0.1, by $36,000 to get $3,600 in annual interest.

What is note note financing? A note-on-note financing refers to the fact that our investment is backed by the underlying mortgage rather than the underlying property.

Similarly, How does a note work?

How Does a Note Work? As mentioned, a note serves as a promise that a borrower must repay a debt plus interest, typically over a set period of time. Notes function similarly to bonds. Both are types of debt securities in which the borrower is obligated to repay the loan plus interest over a predetermined time frame.

What is a note payment?

Notes payable are written agreements (promissory notes) in which one party agrees to pay the other party a certain amount of cash. Alternatively put, a note payable is a loan between two parties. A note payable contains the following information: The amount to be paid. The interest rate.

Do notes payable have interest?

Notes payable almost always require interest payments. The interest owed for the period the debt has been outstanding that has not been paid must be accrued. Accruing interest creates an expense and a liability. A different liability account is used for interest payable so it can be separately identified.

How do you record a note payment?

For the first journal entry, you would debit your cash account in the amount of the loan: $50,000, since your cash increases once the loan has been received. You will also credit notes payable to record the loan. There is always interest on notes payable, which needs to be recorded separately.

What is a note and B note?

A type of promissory note executed and delivered by the borrower under a commercial real estate loan. A B-note is subordinate to one or more senior promissory notes, which are referred to as A-notes.

What is the difference between a loan and a note?

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

Is a loan note debt or equity?

Also commonly known as loan stock, loan notes constitute a particular type of debt security called debentures. … Convertible loan notes represent a right to subscribe for, or convert the loan note into, shares in the issuing company and so will generally be unsecured.

Is a note considered a loan?

A loan note is a type of financial instrument; it is a contract for a loan that specifies when the loan must be repaid and usually also the interest payable.

Is note the same as a loan?

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

How do you write notes?

Top ten tips for writing notes

- Date your notes and make the main topic visible. …

- Don’t write everything down – write down the important points. …

- Make short notes of the examples given. …

- Use colour. …

- Use illustrations and drawing. …

- Use headings and sub-headings. …

- Keep your sentences short.

What is notes payable with example?

What is an example of notes payable? Purchasing a building, obtaining a company car, or receiving a loan from a bank are all examples of notes payable. Notes payable can be referred to a short-term liability (lt;1 year) or a long-term liability (1+ year) depending on the loan’s due date.

Are notes payable debt?

Because they are money owed by the company, both short and long-term notes payable are considered liabilities. … While they are both a form of debt capital, only long-term liabilities (and therefore long-term notes payable) are considered a part of a company’s capital structure.

Does a discounted note payable provide credit without interest?

No. A discounted note payable has no interest rate, but provides interest by discounting the note payable proceeds. The discount, which is the difference between the proceeds and the face of the note, is the interest and is accounted for as such.

Is notes payable a debt?

Because they are money owed by the company, both short and long-term notes payable are considered liabilities. … While they are both a form of debt capital, only long-term liabilities (and therefore long-term notes payable) are considered a part of a company’s capital structure.

Is notes payable interest bearing debt?

Long-Term Notes Payable are longer in nature and typically reflect debt which is over a year (Example: A 10-year loan that the company takes to buy new equipment). Typically, Notes Payable of a company incur interest (however, there are non-interest bearing Notes as well).

How do you record notes receivable with interest?

Assuming that no adjusting entries have been made to accrue interest revenue, the honored note is recorded by debiting cash for the amount the customer pays, crediting notes receivable for the principal value of the note, and crediting interest revenue for the interest earned.

Is Notes payable debit or credit?

When repaying a loan, the company records notes payable as a debit entry, and credits the cash account, which is recorded as a liability on the balance sheet. After this, the business must also consider the interest percentage on the loan.

Is a note payable an expense?

Liabilities are obligations that have yet to be paid, expenses are obligations that have already been paid in an effort to generate revenue. … For this reason, mortgage obligations fall under “notes payable,” none of these are classed as accounts payable.