Multiply the term rate by the note’s face value to calculate the interest. If the example’s face value was $20,000 multiply 0.025 by $20,000 to get the simple interest of $500.

Just so, What are zero interest bearing notes?

Zero interest bearing notes are those debt instruments issued by a company which do not have any coupon rate attached to them. In case of issue of such instruments, the issuing company is not obligated to pay any periodic interest to the investors. These are also called zero coupon bonds.

How do you calculate interest on a note?

Similarly, How do you calculate interest in notes payable?

Calculating Interest Expense

Divide the annual interest expense by 12 to calculate the amount of interest to record in a monthly adjusting entry. For example, if a $36,000 long-term note payable has a 10 percent interest rate, multiply 10 percent, or 0.1, by $36,000 to get $3,600 in annual interest.

How do I calculate interest?

Simple Interest Formulas and Calculations:

Use this simple interest calculator to find A, the Final Investment Value, using the simple interest formula: A = P(1 + rt) where P is the Principal amount of money to be invested at an Interest Rate R% per period for t Number of Time Periods.

What is bearing note?

An interest bearing note represents funds loaned by a lender to a borrower, on which interest is accrued in accordance with the terms of the agreement. … A third example of an interest bearing note is a long-term loan to a company, which is used to support its funding requirements over a multi-year period.

What is the difference between interest bearing and non interest bearing notes?

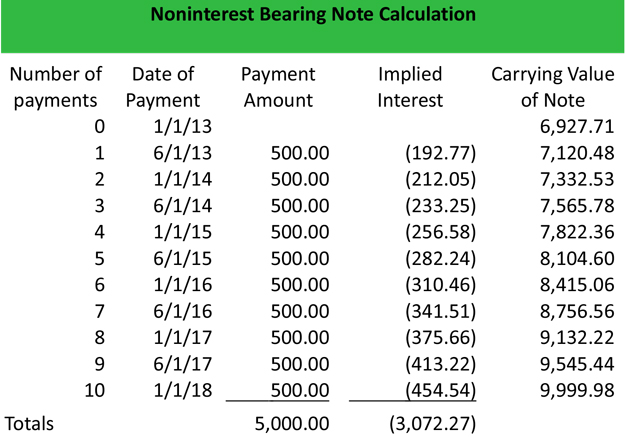

In this lesson, you learned how to account for interest-bearing and non-interest bearing notes. The big difference between the two is that for non-interest bearing notes you need to calculate how much the implied interest is and subtract that from the note payable due on the maturity date.

How do zero interest bearing notes payable relate to discounts?

What is a discount as it relates to zero-interest-bearing notes payable? … The discount represents the credit quality of the borrower. The discount represents the cost of borrowing.

How do you calculate interest on a 90 day note?

How is interest calculated on a straight note?

To calculate the interest for each period, simply divide the total interest to be paid over the life of the bond by the number of periods, be it months, quarters, years or otherwise. For most term bank debt like mortgages or installment loans, the straight-line method is very simple.

What is a note payment?

Notes payable are written agreements (promissory notes) in which one party agrees to pay the other party a certain amount of cash. Alternatively put, a note payable is a loan between two parties. A note payable contains the following information: The amount to be paid. The interest rate.

Do notes payable have interest?

Notes payable almost always require interest payments. The interest owed for the period the debt has been outstanding that has not been paid must be accrued. Accruing interest creates an expense and a liability. A different liability account is used for interest payable so it can be separately identified.

How do you calculate interest in accounting?

You figure simple interest on the principal, which is the amount of money borrowed or on deposit using a basic formula: Principal x Rate x Time (Interest = p x r x t). Your intermediate accounting textbook may substitute n for time — the n stands for number of periods (time).

What is interest amount formula?

You can calculate Interest on your loans and investments by using the following formula for calculating simple interest: Simple Interest= P x R x T ÷ 100, where P = Principal, R = Rate of Interest and T = Time Period of the Loan/Deposit in years.

How is interest calculated monthly?

To calculate the monthly interest, simply divide the annual interest rate by 12 months. The resulting monthly interest rate is 0.417%. The total number of periods is calculated by multiplying the number of years by 12 months since the interest is compounding at a monthly rate.

How do I calculate interest on a loan?

Calculation

- Divide your interest rate by the number of payments you’ll make that year. …

- Multiply that number by your remaining loan balance to find out how much you’ll pay in interest that month. …

- Subtract that interest from your fixed monthly payment to see how much in principal you will pay in the first month.

How do you record a note payment?

For the first journal entry, you would debit your cash account in the amount of the loan: $50,000, since your cash increases once the loan has been received. You will also credit notes payable to record the loan. There is always interest on notes payable, which needs to be recorded separately.

What is a 90 day note payable?

A 90-day loan note with a bank is a short-term financing instrument with a fixed interest rate that can be issued to consumers or businesses. The note is usually paid as a coupon. This means that the entire value of the loan with interest is repaid on the 90th day after the loan is issued.

Does a non interest bearing note have interest?

Definition: A noninterest-bearing note is a note or bond with no stated interest rate on its face. Contrary to the name, noninterest-bearing notes do actually pay interest. The interest is implied in the face value of the note.

What is interest bearing principal balance?

Upon entering the servicing phase of the loan cycle: Interest bearing loans track the principal balance (not including unearned interest) as the “outstanding balance due” and interest for a specific period is computed at the stated rate at the time a payment is posted.

What are interest bearing liabilities?

Interest-bearing liabilities are debts that cost money to hold. They include most financial liabilities that businesses commonly have, including bank loans and corporate bonds. … As reported by Accounting Tools, A non-interest bearing liability is a debt for which the borrower does not need to pay any rate of interest.