If you’re looking to open a bank account in Switzerland, the documentation you’ll need is:

- A valid passport,

- Verification of the origin of your income (this could be a statement from your last bank),

- Confirmation of the address you listed (they might choose to send some mail to your address to verify this).

Just so, Is Maestro accepted in Switzerland?

In Switzerland, the eurozone and other countries where it is accepted (e.g. the USA), a Maestro card allows you to make payments at any terminal and withdrawals from any ATM.

Can foreigners open a bank account in Switzerland? Swiss banks are happy to have foreign residents as customers. You can hold an account in Swiss francs or in a range of other world currencies. Each bank will set the minimum deposit amount for opening the account, so you will need to find a bank that will accept the amount of funds you have.

Similarly, How much money do I need to open a Swiss bank account?

They typically require that you physically go to the bank in Switzerland. They also typically require an initial deposit of at least $100,000 and cost about $300 per year or more to maintain.

Is it illegal to have a Swiss bank account?

The act of depositing money in any bank, Swiss or otherwise, isn’t illegal itself. Swiss banks, because of the nature of their country’s laws used to manage to keep their account holder details a secret, making them the obvious choice to stash away unaccounted for wealth.

Is Maestro or Visa better?

When comparing the two cards, Visa is the more widely accepted card than Maestro. Visa has a more foreign reach than Maestro. Visa is accepted more by the websites and also by shops and other establishments than the Maestro. When talking of protection, Visa cards give a better protection than Maestro.

What’s better Maestro or MasterCard?

The key difference is that Maestro is available only as a debit card, whereas Mastercards can be issued as a debit, credit, or prepaid card.

What is the difference between Maestro and MasterCard?

Maestro provides direct cash access from the bank account. … MasterCard is a credit card whereas Maestro is a debit card. 2. Most financial transactions of MasterCard are confirmed by signature while the financial transactions of Maestro are confirmed by a Maestro PIN (Personal Identification Number).

Which Swiss bank is best for foreigners?

If you’d like to open a fully-fledged free Swiss bank account, Neon offers the best Swiss bank account for foreigners looking to keep the fees low while still receiving their salary. Similarly to Revolut, Neon runs entirely out of a mobile app and has no branches or online banking.

How can I get Swiss citizenship?

have at least one parent who has a residence permit and has been in Switzerland for 10 years. were born in Switzerland and have a C residence permit. have attended at least 5 years of compulsory schooling in Switzerland. meet the other requirements regarding language, integration, and respecting public order.

Do Swiss banks report to IRS?

Under the Swiss Foreign Account Tax Complaint Act (FATCA), which came into effect on June 30, 2014, Swiss financial institutions must provide U.S. tax authorities (IRS), directly with the account information that is subject to reporting with the consent of the clients concerned.

Can an American open a Swiss bank account?

Account Opening And Wealth Protection In Switzerland. … But US citizens can still open bank accounts in Switzerland that are tax compliant and follow the rules of the U.S Securities and Exchange Commission (SEC) and can help them protect money invested in the country from law cases in the U.S.

Which is the safest bank in the world?

World’s safest banks

| Rank | Bank | Country |

|---|---|---|

| 1 | KfW | Germany |

| 2 | Zuercher Kantonalbank | Switzerland |

| 3 | Landwirtschaftliche Rentenbank | Germany |

| 4 | L-Bank | Germany |

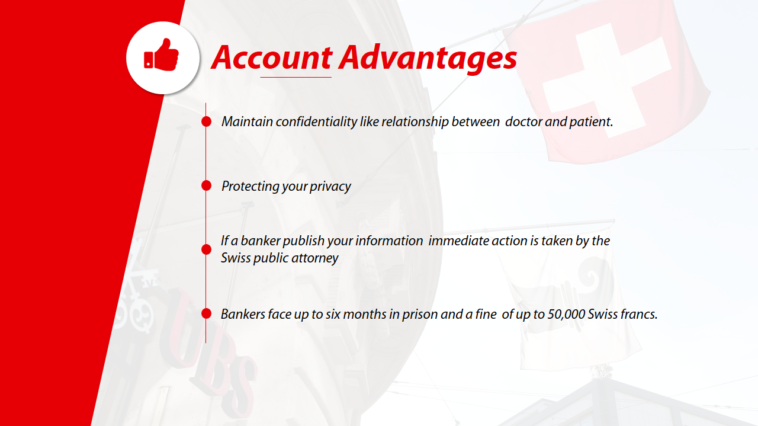

Why do criminals use Swiss bank accounts?

Because of this act, bankers who release information about private clients or acknowledge the existence of client accounts face criminal charges. 1 Over time, the privacy of Swiss banks has been used to hide Nazi wealth, protect assets of the persecuted, and help countless others keep a low profile.

What is the best country to hide money?

5 Best Countries to Open Offshore Bank Accounts

- 5 Best Countries to Open Offshore Bank Accounts. …

- Cayman Islands. …

- Switzerland. …

- Singapore. …

- Germany. …

- Belize.

Is V pay a Visa card?

Together, we are V Pay. It is a system of payment by Visa Europe, which is constantly being developed in collaboration with European and national decision-making bodies and used by more and more banks. VISA itself speaks of a “great dynamics in the innovation front.”

Is Visa a credit card?

Financial institutions issue Visa credit cards to consumers whom they deem creditworthy based on their credit report. Visa credit cards provide cardholders with convenience and security and can be used at merchants and automated teller machines (ATMs) around the world.

Can I use Maestro card in UK?

4 Answers. None of the banks above issue a Maestro Card. The only banks active in the UK who DO issue Maestro cards are a company called Quidity, a company called Splash, and Revolut. And Revolut will only issue you with a Maestro Card if you live in Germany, Austria or the Netherlands!

What is difference between Visa and Maestro card?

Visa cards come with credit or debit facilities whereas Maestro cards are debit cards only; therefore, do not provide a credit facility. The Maestro cardholder can only make payments up to the amount that is held in their bank account, or must set an overdraft arrangement with the bank.

Do Maestro cards have a CVV?

Type down your first 16 digit card number from 19 digits. The last 3 digits of your Maestro card is the CVV number.

Is Maestro accepted everywhere?

The Maestro brand enhances traditional ATM debit cards, giving cardholders secure access to their money wherever they travel—and enabling them to make purchases and get cash in local currency anytime, anywhere.

Do Maestro cards still exist?

Maestro has been replaced by the banks that issued it with Debit Mastercard. Moreover, the largest Danish bank Danske Bank has replaced all of its cash cards with Debit Mastercards.