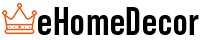

How much do I need to give to charity to make a difference on my taxes? Charitable contributions can only reduce your tax bill if you choose to itemize your taxes. Generally you’d itemize when the combined total of your anticipated deductions—including charitable gifts—add up to more than the standard deduction.

Just so, How much are donations worth on taxes?

In general, you can deduct up to 60% of your adjusted gross income via charitable donations (100% if the gifts are in cash), but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, …

What is the max charitable donation for 2020? Individuals can elect to deduct donations up to 100% of their 2020 AGI (up from 60% previously). Corporations may deduct up to 25% of taxable income, up from the previous limit of 10%.

Similarly, What are the benefits of donating to charity?

9 Positive Effects of Donating Money to Charity

- Experience More Pleasure. …

- Help Others in Need. …

- Get a Tax Deduction. …

- Bring More Meaning to Your Life. …

- Promote Generosity in Your Children. …

- Motivate Friends and Family. …

- Realize that Every Little Bit Helps. …

- Improve Personal Money Management.

Can you save money by donating to charity?

Charitable giving can help those in need or support a worthy cause, but at the same time it can also lower your income tax expense. Eligible donations of cash as well as items are tax deductible, but be sure to keep donation receipts and that the recipient is a 503(c) charitable organization.

Can you donate to your own charity?

Yes, you are able to donate to a charity that you founded. You can make a tax-deductible donation to any 501(c)(3) charity, regardless of your affilitation with it.

How do billionaires get out of paying taxes?

Billionaires have avoided taxation by paying themselves very low salaries while amassing fortunes in stocks and other assets. They then borrow off those assets to finance their lifestyles, rather than selling the assets and paying capital gains taxes.

How much can you claim in charitable donations without getting audited?

Non-Cash Contributions

Donating non-cash items to a charity will raise an audit flag if the value exceeds the $500 threshold for Form 8283, which the IRS always puts under close scrutiny. If you fail to value the donated item correctly, the IRS may deny your entire deduction, even if you underestimate the value.

Do you need receipts for charitable donations?

There is no specific charitable donations limit without a receipt, you always need some sort of proof of your donation or charitable contribution. … Donations of more than $250 require a written acknowledgement from the charity. In most cases, you should submit this acknowledgement with your tax return.

How much charitable donations will trigger an audit?

Donating non-cash items to a charity will raise an audit flag if the value exceeds the $500 threshold for Form 8283, which the IRS always puts under close scrutiny. If you fail to value the donated item correctly, the IRS may deny your entire deduction, even if you underestimate the value.

What is the 30% limit on charitable contributions?

Contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations are limited to 30 percent adjusted gross income (computed without regard to net operating loss carrybacks), however.

What are the advantages and disadvantages of charitable giving?

Advantages & Disadvantages of Charitable Foundations

- Advantage: Tax Benefits.

- Advantage: Better-Informed Donors.

- Advantage: Family and Friends Benefits.

- Disadvantage: Initial Commitment.

- Disadvantage: Ongoing Effort.

Does giving to charity make a difference?

Feel Wealthier

Your contributions may do more than just create a feeling of wealth. Some experts suggest that you’re more likely to stick to a budget and manage your personal finances more effectively when you commit to regular charitable donations. The result could actually be greater financial wealth.

Why is donating so important?

This article covered many reasons why donating is so important. It outlines evidence supporting the claims that (i) charity helps people who need it, (ii) giving to charity promotes donors’ wellbeing, and (iii) charity can help make the world a fairer place.

Can you take charitable donations without itemizing in 2020?

Following tax law changes, cash donations of up to $300 made this year by December 31, 2020 are now deductible without having to itemize when people file their taxes in 2021. … This change allows individual taxpayers to claim a deduction of up to $300 for cash donations made to charity during 2020.

What are some of the worst charities to give to?

here, in no particular order, we take a look at some of the worst charities of 2019.

- Cancer Fund of America. …

- American Breast Cancer Foundation. …

- Children’s Wish Foundation. …

- Police Protection Fund. …

- Vietnow National Headquarters. …

- United States Deputy Sheriffs’ Association. …

- Operation Lookout National Center for Missing Youth.

How can I legally accept donations?

The acknowledgment must include your nonprofit’s name, the amount of the donation or the value of the donated goods, and a statement of any goods or services received in return for the gift. Adequate acknowledgment is an essential service your donors need to claim their tax benefit.

Are donations taxable?

Charitable donations of goods and money to qualified organizations can be deducted on your income taxes, lowering your taxable income. Deductions for charitable donations generally cannot exceed 60% of your adjusted gross income, though in some cases limits of 20%, 30% or 50% may apply.

How can I legally not pay taxes?

If you want to avoid paying taxes, you’ll need to make your tax deductions equal to or greater than your income. For example, using the case where the IRS interactive tax assistant calculated a standard tax deduction of $24,800 if you and your spouse earned $24,000 that tax year, you will pay nothing in taxes.

Can I refuse to pay federal income tax?

In general, it is illegal to deliberately refuse to pay one’s income taxes. Such conduct will give rise to the criminal offense known as, “tax evasion”. Tax evasion is defined as an action wherein an individual uses illegal means to intentionally defraud or avoid paying income taxes to the IRS.

Why do millionaires not pay taxes?

America’s billionaires avail themselves of tax-avoidance strategies beyond the reach of ordinary people. Their wealth derives from the skyrocketing value of their assets, like stock and property. Those gains are not defined by U.S. laws as taxable income unless and until the billionaires sell.